Charitable Remainder Annuity Trust

Many individuals are looking for a way to receive fixed income for life or a number of years. They also may be concerned about capital gains upon the sale of an appreciated asset. A Charitable Remainder Annuity Trust is a great way to achieve your personal goals while supporting Promises2Kids.

Benefits of a Charitable Remainder Annuity Trust

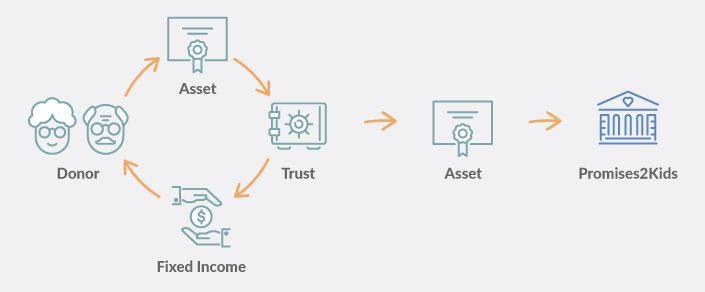

How a Charitable Remainder Annuity Trust Works

1Transfer Cash or Assets to Fund a Charitable Remainder Annuity Trust

2If Funded with Appreciated Assets, the Trust Sells the Assets Tax Free

3Trust is Invested and Pays Fixed Income to You or Your Beneficiaries for Life or Term of 20 Years

4Receive a Tax Deduction in the Year You Fund the Trust

5Promises2Kids Benefits from the Remainder of the Trust After the Trust Payments Have Been Made

Need Assistance?

For questions about establishing a Charitable Remainder Annuity Trust to benefit Promises2Kids or to notify us of your gift, please contact Amanda Baumann, Director of Philanthropy at 714.414.6529 or amanda@promises2kids.org

Interested in Learning More?

Our Free Estate Planning Guide Can Assist with Planning Your Will & Trust

This complimentary, Estate Planning Guide will help you work alongside your advisor and show you the many ways you can leave a legacy to Promises2Kids, your family or your community.

Please fill out the form below to receive the guide or contact James Sison, Major Gifts Officer at 619-815-0783 or James@promises2kids.org.