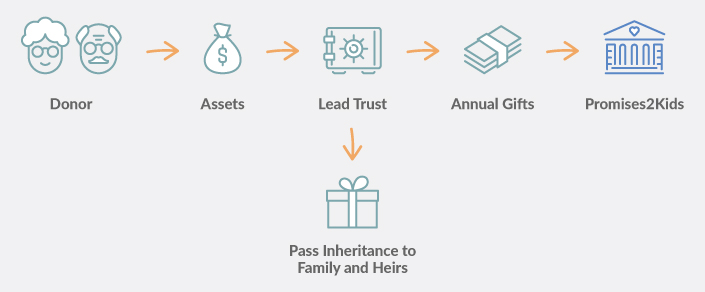

Charitable Lead Trust

If you are interested in passing on some assets to your family and heirs while reducing or even eliminating taxes, and supporting Promises2Kids at the same time, then a Charitable Lead Trust is a wonderful option.

Benefits of a Charitable Lead Trust

How a Charitable Lead Trust Works

1Contribute Your Asset or Property to Fund a Trust that Pays Promises2Kids for an Established Number of Years

2Receive a Tax Deduction at the Time of Your Gift

3After Period is Over, Your Heirs Receive the Trust Assets in Addition to Any Interest or Value Earned

Need Assistance?

For questions about establishing a Charitable Lead Trust to benefit Promises2Kids or to notify us of your gift, please contact Dani Dawson, Chief Advancement Officer, at 858-997-3047 or danid@promises2kids.org.

Interested in Learning More?

Our Free Estate Planning Guide Can Assist with Planning Your Will & Trust

This complimentary Estate Planning Guide will help you work alongside your advisor and show you the many ways you can leave a legacy to Promises2Kids, your family, or your community.

Please fill out the form below to receive the guide or contact Dani Dawson, Chief Advancement Officer, at 858-997-3047 or danid@promises2kids.org.